In the early days of pandemic, when we were convinced absolutely everything one touched would make one fatally ill, money presented a particular problem. Cash was unappealing to use—imagine looking at a dollar bill under a microscope! Credit cards weren’t much better when you thought about swiping it into a machine used by others, using a touchpad screen to enter a pin that everyone touches, or even worse, using a store’s pen to sign a paper receipt. Every interaction: a life and death decision. Just to buy a few things at CVS!

It was then that I finally got around to turning on Apple Pay on the phone, and the magic of hovering your phone near a credit card reader—no touching required—became the magic shield to protect oneself from the pandemic. The same story with the countless people I recruited to join Venmo to avoid other awkward cash transactions.

Covid is long gone, but what has long resonated with me is the absurdity of all the logistics surrounding money. There’s just too much friction when it comes to transactions, and the benefits of many innovations throughout history serve to reduce friction, or the removal of barriers that make a transaction or task difficult. Money—and everything to do with it—shows, perhaps more than anything, that friction that still exists, and we have a way to go before all friction related to money is removed. We’re in the early days of technology making money simple,

Money is a store of value, and financial innovation generally revolves around removing the barriers inherent with moving money from one entity to another, and from one point in time to another.

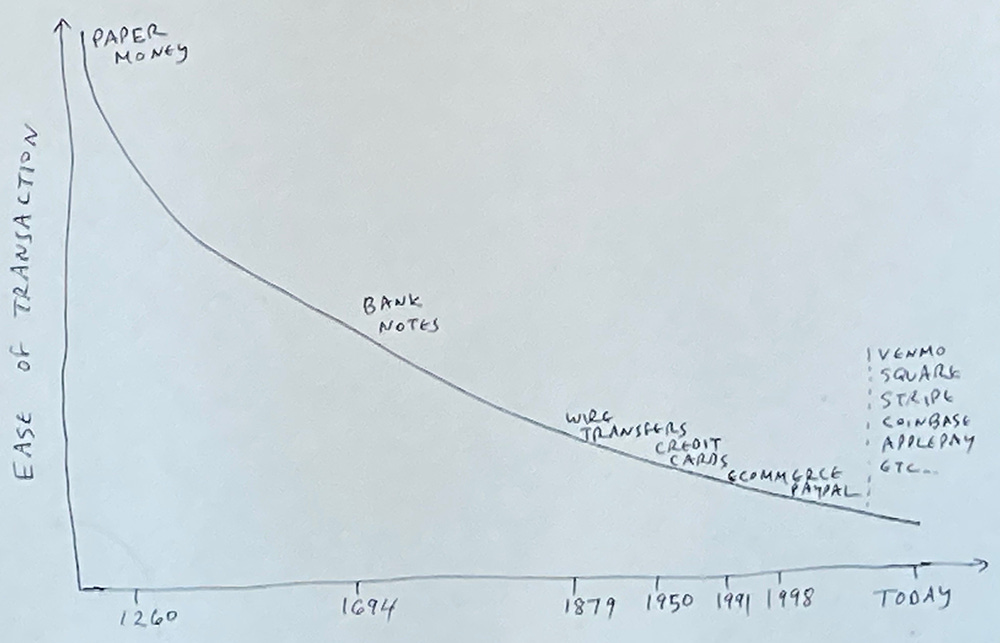

Here’s a simplified look at financial services innovation over the last thousand years:

The overarching theme: making it easy and reducing the cost--eliminating friction--associated with moving money from party to another, whether that is a person or company.

We can see a similar trend in making things easier to move money from one point in time to another. This is done by borrowing money, so I have more money today at the expense of less money tomorrow, or by investing money, so I have less money today with the promise of more money tomorrow (via loan or equity investment). From agricultural lending in ancient Mesopotamia to banks in the Renaissance and the emergence of ETFs in the 1970s, the long-term trend is removing the friction associated with time-shifting money. A large class of contemporary finance startups have accelerated this trend: everything from Robinhood eliminating the cost of stock trades to LendingClub reducing the cost of borrowing money through peer-to-peer loans.

As much progress as we’ve made over the last decade, money is still replete with friction. Often, too many rent-seeking middlemen lie behind seemingly basic movements of money. You can see it in every corner where excess profits exist: 18% credit card interest rates; exorbitant payday loans; the 30% transaction fee for Apple Store payments; the 2% stores must pay to credit card companies for the convenience of accepting plastic; the wide disparity in interest rates paid by your local Bank of America compared to a lesser-known online bank. And you can see it in the inconvenience we all put up with: the piles of bills and tedious paperwork that’s still required every month for so many of us; calculating taxes due, when most of us have our tax information already sent by our bank and companies directly to the IRS; the cost and time delay associated with wiring money. Not to mention the confusion so many of us have when it comes to generally managing our finances and planning for our future. And that’s before talking about the endless number of transaction and financing challenges that exist in almost every business sector.

So as much as I’m happy technology has made it possible for me to pay with just my phone—I don’t even carry around a wallet or credit card anymore—we’re in the second inning technology disintermediating finance. Excess profit and inconvenience are waiting to be eliminated.